5 Amazing Reasons Why Making an Investment in Gold is a Profitable Idea

In India, gold not only has just monetary value but also has sentimental value associated with it. Gold symbolizes wealth and prosperity in India. Whether it is a wedding or just a small family function, we Indians just love gold. Apart from all this, gold is also treated as an investment. It helps people in financial crises and can provide instant financial assistance. In the traditional society, it holds not only an aesthetic value but also works as a means of credible investment. But have you ever wondered, what makes gold such an important commodity even when it doesn’t provide any interest. Today, we will be answering those questions only. Here are 5 amazing reasons that make gold a very rational and profitable choice to invest.

5 Reasons Why Everyone Should Invest in Gold

Universal Commodity

Gold is one of the rare commodities which is universally accepted as well as desired. Also, gold takes the lead over other countries currencies, treasuries, & securities, as gold rates have always been away from political chaos.

Guard Against Inflation

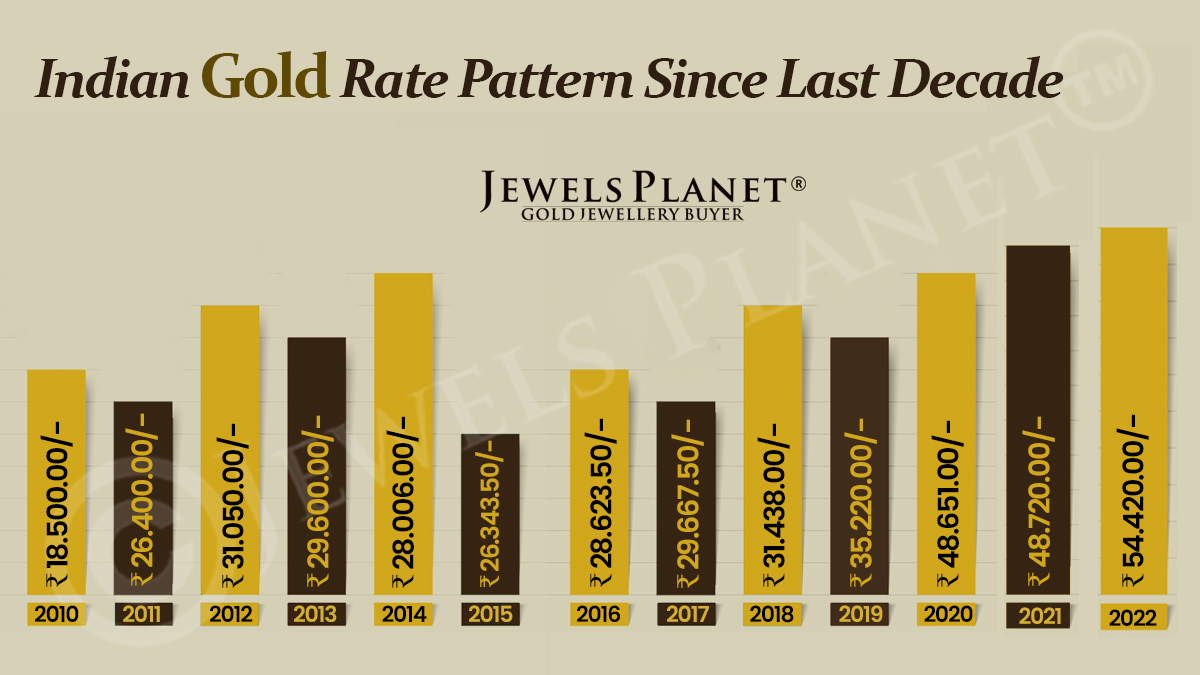

It has been tried time and once more that gold gives a solid shield against inflation. Gold rates stay nearly unaffected at the time of inflation. So, you do not have to suffer a misfortune when the inflation hits and even the money rates go down in the global market. Presently, talking within the Indian setting, the esteem of Rupee has not been performing well in 2020 and thus, contributing in gold isn’t a bad thought at all.

Always Trending

Gold is a valuable metal and we all know that. Also, gold holds an uncommon put in any Indian family and is considered the wealth of the family, for case, the gold gems are passed on from one era to the other as a bequest and an image of family wealth.

High Liquidity

One of the primary motives for making any monetary expenditure is that you consider it as a backup if in case you need it in future and gold is one of the most convenient assets to liquidate. In case, you show up to be in need to use your gold to make your ends meet, you can anytime get cash against gold . There are always gold buyers equipped to purchase this precious metal. But remember the return price may not be always what you expect.

Diversification

Adding distinct securities to your portfolio is an imperative way to diversify and lower the typical threat to your investments. Moreover, due to the fact that gold regularly strikes inversely to the stock market and currency values, it gives a particularly effective way to diversify.

Value is Stable

Gold tends to preserve its price over time. Economists argue that even the rate of gold is not indicative of its value. That is, even if the charge decreases, the underlying price of gold does not alternate much. This is generally because there is a fixed volume of gold due to the fact that it is a commodity, whereas the U.S. dollar, which is a structure of fiat currency, holds no inherent value.

Got the reasons? Now read the expert’s final words regarding your investment.

Final Words

Gold can be a beneficial investment when all the other investments fall flat. In fact, if you’re concerned about inflation or the depreciation of your country’s cash, you must need to include gold in your portfolio. Also, Jewellery is not the only option if you want to invest in gold; there are various other options available too. For example, Gold ETF, Gold Bars and coins, Gold funds, etc.